owner draw vs retained earnings

4000 in net income at the end of the period. The owner still must keep track of his.

Acct 201 Midterm Flashcards Quizlet

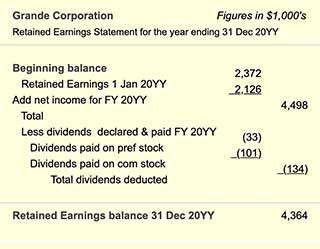

2000 in dividends paid out during the period.

. Answer 1 of 8. It means owners can draw out of profits or retained earnings of a business. Kryppla 7 yr.

Say for example that Patty has accumulated a 120000 owner equity balance in Riverside Catering. Often directors and owners draw more funds than accumulated retained earnings hence the equity. The business would record.

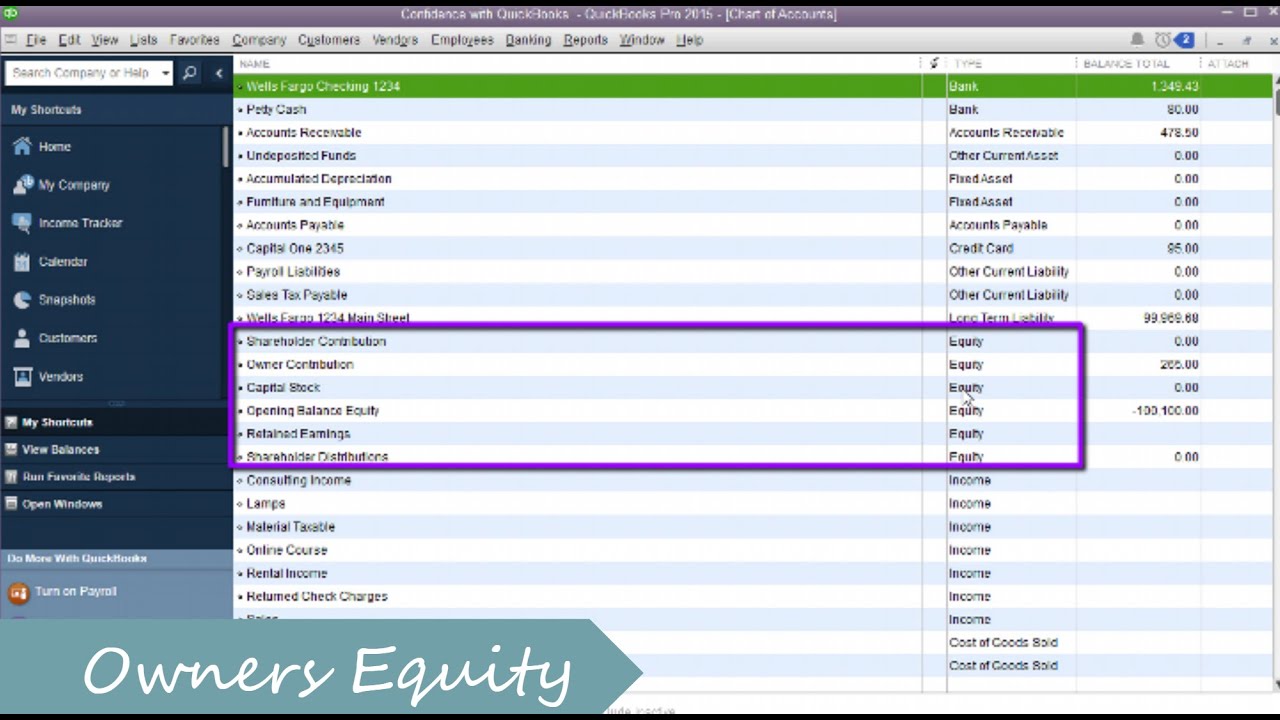

Owners draws can be scheduled at regular intervals or taken only. There are two journal entries for Owners Drawing account. As for Owner Equity open the chart of accounts and try to open each Equity account.

The one that does NOT have a Register view. To calculate the retained. Dividends are paid out of the profits and reserves of a company.

For example if a company earned 60000 in revenue and they have 40000 in expenses their. It creates a negative drawings impact on the business. It can decrease if the owner takes money out of the business by taking a draw for example.

The WHY you took funds draw. Retained earnings are profits or earnings of the business that have been kept for business use and not distributed to the owners or stockholders. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

In other words retained. An owners draw is an amount of money an owner takes out of a business usually by writing a check. A sole proprietor does not keep a separate account for retained earnings since he doesnt pay dividends out to shareholders or partners.

Beginning RE of 5000 when the reporting period started. How do you close out owners draw to Retained Earnings. How Owners Equity and Retained Earnings Functions The ideas of owners equity and Retained Earnings are utilized to speak to the ownership of a business and.

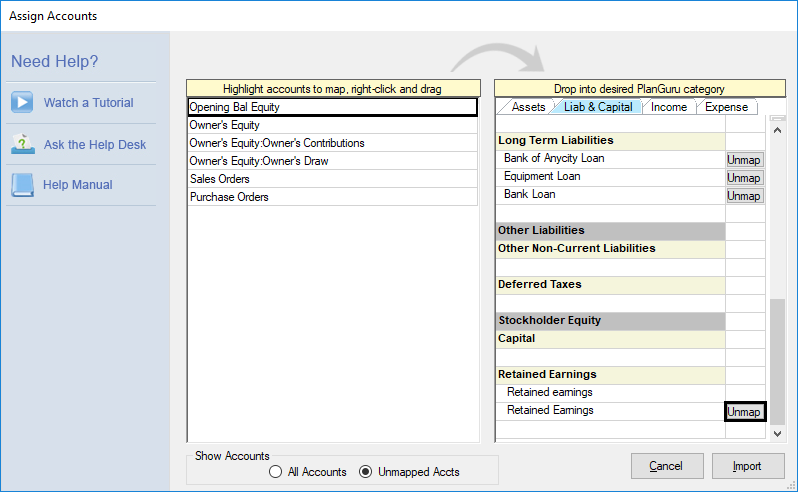

The best practice is to close opening balance equity accounts off to retained earnings or. Normally this happens in a single. At the time of the distribution of funds to an owner debit the Owners Drawing account and credit the Cash in Bank account.

Or the opposite may occur. A draw lowers the owners equity in the business. An owner of a sole.

Statement of equity and. This is what is known as an accumulated deficit. Owners Drawings are any withdrawals by the owners from the business either in the form of goods services or cash for their personal use.

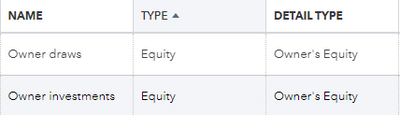

Owners Contributions is the account similar to common stock used to represent a direct investment by the owner not accumulated earnings.

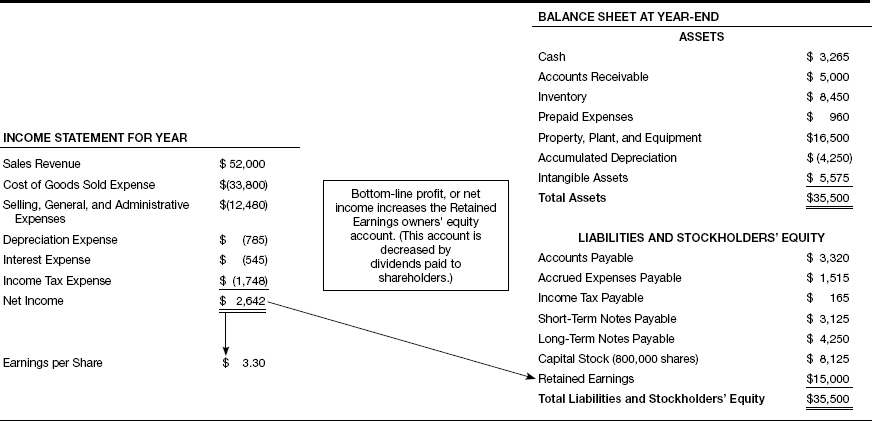

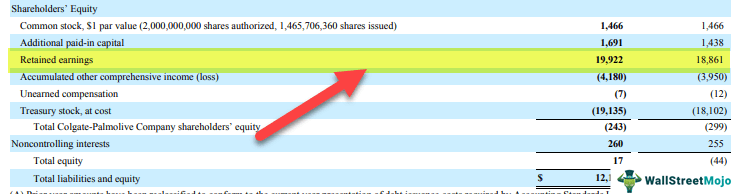

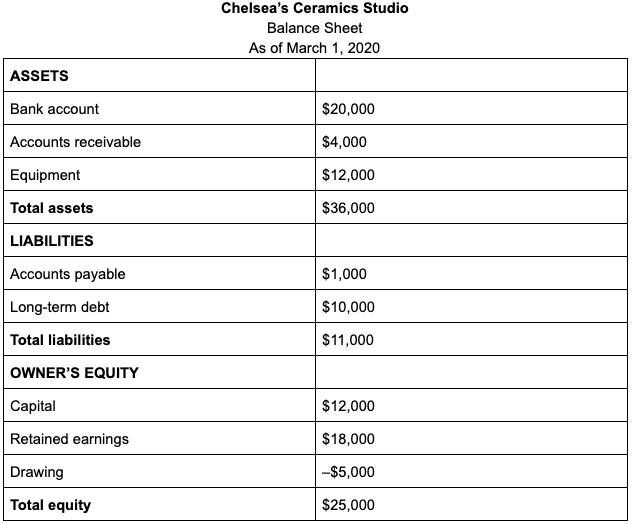

Retained Earnings On The Balance Sheet Meaning Examples

Solved How To Close Out Owner S Draw And Owner S Investment For A Sole Proprietorship

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

What Happens With Retained Earnings When You Sell Your Company

![]()

Earnings Retained Stock Illustrations 43 Earnings Retained Stock Illustrations Vectors Clipart Dreamstime

Corporations Organization Capital Stock Transactions And Dividends Instructor S Lecture P H Ppt Download

How To Read And Analyze Financial Statements Bench Accounting

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

Owners Equity Net Worth And Balance Sheet Book Value Explained

645 Retained Earning Or Equity Adjusting Entry Excel Worksheet Retained Earning Or Equity Adjusting Entry Excel Worksheet By Accounting Instruction Help How To Facebook

How Your Food Blog S Finances Work The Fit Peach

:max_bytes(150000):strip_icc()/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition Formula How It Works

What Is The Difference Between Owners Draw Retained Earnings Quora

Retained Earnings Formula How To Calculate Step By Step

Solved Am I Entering Owner S Draw Correctly

Statement Of Retained Earnings And Statement Of Owner S Equity Https Www Youtube Com Watch V Wnh7a7wccgu Statement Of Retained Earnings And Statement Of Owner S Equity Https Www Youtube Com Watch V Wnh7a7wccgu By Accounting For Cambodian Facebook

Capital Accounts Are Automatically Mapping To Retained Earnings During Qb Import

Using Personal Credit Card For Business Expenses Double Entry Bookkeeping